State govt urged to slash Sales Tax on fuel

Bangaloreans are demanding that the State government reduce its Sales Tax on fuel and ease the burden on consumers. Remove or minimise local taxes on petrol and diesel which is higher when compared to neighbouring states, they demanded of Chief Minister B S Yeddyurappa, while urging the Centre to fix a uniform rate for petrol and diesel throughout the country.

Central allocation of funds is based on the amount of tax collected in a state. Hence, the state is collecting higher taxes to get maximum funds from the Centre instead of augmenting its revenue by plugging revenue leakage and bringing to book the defaulters, argue vehicle users who complain of ever bulging petrol budgets.

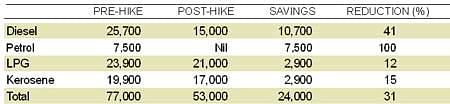

It is estimated that at around current crude prices of $75 per barrel, the under-recoveries for the Oil Marketing Companies (OMCs) from the fuel price hike will come down by Rs 22,000 crore this year. The overall burden of under-recovery on the OMCs from all the four fuel products – petrol, diesel, LPG and kerosene – was earlier estimated around Rs 78,000 crore.

Deccan Herald is on WhatsApp Channels | Join now for Breaking News & Editor's Picks