Ambanis on overdrive to expand business

India’s billionaire Ambani brothers are virtually on an overdrive signing deals in quick succession after putting a full stop to their five-year battle over the spoils of their father’s vast business empire.

The warring siblings, Mukesh, who is now 53, and Anil, 51, buried the hatchet in May 23, this year on a bitter acrimony arising from the division of the Ambani empire. As per the business split agreement Mukesh got control of flagship Reliance Industries (RIL) with interests in petrochemicals, oil and gas exploration, refining and textiles, while Anil got 5-firms such as Reliance Communications (telecom), Reliance Infrastructure, Reliance Capital, Reliance Power and Reliance Natural Resources (RNRL).

Since then, Mukesh launched retail venture, while Anil branched into media and entertainment. But soon after the division of assets, brothers went to court to fight on the issue of gas allocation by Mukesh’s company to Anil’s power projects. After the Supreme Court’s judgment in favour of Mukesh, the brothers decided to have a peace agreement and stop fighting. Result of a realisation by Ambani siblings that they wasted their precious time and resources over legal battles at the cost of their very business growth.

Now that the Ambani duo have promised a new “environment of harmony, cooperation and collaboration” in their truce, what they actually mean is it provides greater flexibility and business opening to their respective groups. Brothers with their families even had a vacation together recently in Africa. Both brothers, with a combined net worth of $43 billion -Mukesh ($29 billion) and Anil (roughly $14 billion) - estimated by Forbes magazine, have charted an aggressive growth path both organically and through M&A route since signing the peace pact in May.

Mukesh’s plans

Mukesh, as chairman of the flagship company Reliance Industries (RIL) at its AGM recently made it amply clear of the aggressive growth path being planned for his company when he stated that RIL will strive to double its balance sheet size in the next five years. For this, the flagship company armed with a huge cash flow will have to find ways to deploy them judiciously. Going by an Goldman Sachs’estimate, RIL will generate free cash flow of $18 billion between the present fiscal year and the one ending March 2014, effectively $6 billion each year.

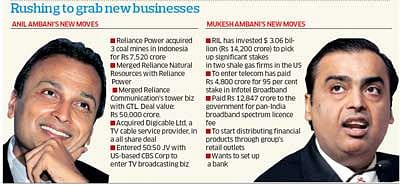

Mukesh first surprised the market by re-entering the telecom sector with the acquisition of 95 per cent stake in Infotel Broadband Limited from HFDC group for Rs 4,800 crore, the only company to have won a countrywide license of broadband wireless spectrum (Wimax) in a recent auction. He will fork out another Rs 12,847 crore to the government as license fee for the spectrum in 22 circles bagged by Infotel.

His move seems to corroborate the fact that he has a special love for telecom sector - after all a decade ago he founded the group’s telecom company Reliance Communications that was ceded to Anil in the family division of assets. Although he may not immediately foray into cellular market where there are already 14-players fighting it out. But it is likely that he would go for the kill when he finds a cellular company ripe for plucking. One should not be surprised if the brothers merge their telecom businesses in future to offer services on the entire spectrum of technology: CDMA, GSM and WiMax.

At least, RIL’s planned foray into new sectors has allayed fears of analysts as to where and how would it deploy the huge cash flows it is expected to generate from its existing energy business. To this, Mukesh recently gave out pointers at the AGM saying that RIL is drawing up specific plans for “mega investments” in the power sector with clean coal-based power generation projects, hydroelectric projects and also in nuclear power (as and when it is opened up for the private sector). To expand its gas business globally, RIL has already bought significant stakes in two shale gas companies in the USA by investing $3.06 billion or Rs 14,200 crore.

Financial sector — hitherto a domain of Anil Ambani — is also within the striking distance of RIL and one must not forget, Mukesh was one of the several domestic tycoons who are keen on setting up a bank if RBI allows. If that is the long term goal, RIL’s medium term vision envisages foray into distribution of financial products using its network of retail chain to sell products like insurance, mutual funds and forex of different players from India and abroad. In the process RIL will also hawk financial products from Anil Ambani group’s insurance and mutual fund companies.

The flagship RIL has already set up few subsidiaries for financial services such as Reliance Retail Finance Limited, followed by insurance broking, financial distribution and advisory services, besides retail travel and forex services. These arms together have assets worth Rs 125 crore on March 31, 2010 shows the serious intent of the flagship company. RIL Group is holding talks with Warren Buffet-led investment firm Berkshire Hathaway and DE Shaw but no confirmation was forthcoming in this context. The latest buzz is that Mukesh, in his personal capacity, may ask R A Mashelkar, former chief of the Council of Scientific and Industrial Research (CSIR) to head his private equity initiative. Mashelkar is already on the board of RIL as an independent director. Speculations are rife that RIL, as part of its treasury operations, has already invested in Axis Bank Private Equity.

Anil’s ambitions

Going by his strategic moves, Anil Ambani seems to be moving faster than his elder brother to expand business after the peace deal. The ADAG (Anil Dhirubhai Ambani group) has gone full hog in the power sector, with Reliance Power (Rel Power) acquiring three coal mines in Indonesia for Rs 7,520 crore, then followed it up with the merger of Reliance Natural Resources Limited (RNRL) - as the apex court verdict left virtually no role for gas trading - with it at a swap ratio of 4:1 in an all share deal estimated to be worth over Rs 50,000 crore. RelPower also achieved financial closure of $3.7 billion Krishnapatnam Ultra Mega Power Project (UMPP) in Andhra Pradesh.

In a smart move, ADAG also clinched Rs 50,000 crore deal to merge the telecom towers of Reliance Communications (RCOM) with GTL Infrastructure aimed at consolidating the tower business. The deal will provide much needed cash to ADAG. Then came RCOM’s acquisition of Digicable, one of the largest cable service providers in the country — with a subscriber base of 8.5 million — in a cashless all stock deal. The group will merge its direct-to-home (DTH) business ‘Reliance BigTV’ with newly formed Reliance Digicom which will enjoy subscriber base of 11 million and market leadership in 110 towns, while having a 16 per cent market share of pay TV homes. Anil’s plan is to grow the subscriber base to over 100 million in a span of five years.

ADAG also announced to form an equal (50:50) joint venture with US-based CBS Corporation to enter the television broadcasting space and has signed the initial pact. Another ADAG promoted entity, Reliance Capital picked up 18 per cent equity in business news channel Bloomberg UTV for an undisclosed sum. The sources maintain that ADAG holds 15 per cent equity in Aaj Tak channel and also holds investment in the Network 18 which operates CNN-IBN, Colours and Awaaz channels.

Shareholders not excited

It is not that shareholders were lapping up every move of Mukesh and Anil, as they are quite divided at times and also confused. RIL shares have been rising ever since the truce pact and even ADAG’s market valuation soared 14 per cent in the June quarter. So much so, the seven listed companies of ADAG starting with RelPower and RCOM have made their investors wealthier by Rs 16,969 crore, but of course the elder Mukesh led RIL continues to maintain its numero uno position, with a total market-cap of Rs 3,57,902 crore at the end of the June quarter.

At the same time, RNRL shareholders — at least 20 per cent of them who have acquired the shares from the open market - felt cheated after the swap ratio with RelPower fixed at 4:1. They contend that going by the pre-merger share prices of two companies the ideal ratio should have been at 3:1. But in the long run investors in both groups should see higher returns as the Ambani brothers now have much more operational and financial flexibility in deciding the future course for their respective groups. They may even work together in some businesses as Mukesh may invest in Anil’s power projects as a gas supplier and Anil may allow Rcom’s fibre optic cables to be used by Mukesh’s broadband venture.