Sponsored ad: This is a paid advertisement by Season Marketing Limited. Season Marketing Limited is authorized and regulated by the Financial Conduct Authority and entered on is the Consumer Credit Register under reference number: 727385.

Direct lenders for payday loans in the UK offer a vital financial lifeline when unforeseen costs arise, and you require immediate cash access. These top-tier lenders streamline the borrowing process with a swift and straightforward online application, ensuring you get the funds you need without delay. With online payday loans from direct UK lenders, you can secure a cash advance that you'll repay once your next paycheck arrives, typically within a few weeks or months. Whether it's for auto repairs, daily expenditures, or sudden bills, the premier direct-only payday lenders in the UK cater to a variety of urgent financial needs.

Researching and comparing different no refusal payday loans UK direct lenders alternatives is essential to find the best deal, but it can be overwhelming. That’s where loan finders of high acceptance payday loans direct lenders UK come in. They make it easy to apply for different payday loans UK direct lenders through a fast and convenient process. These include payday loans direct lenders UK, £50 payday loans direct lenders UK, direct lenders payday loans UK for bad credit, payday loans direct lenders new UK with low interest, poor credit payday loans direct lenders UK, payday loans new direct lenders UK for low income, new payday loans direct lenders UK with quick payouts, and direct lenders payday loans online UK without a job.

They do the legwork and make it easy to access suitable online payday loans direct lenders UK for your situation. To help you find the best payday loans online direct lenders UK, this guide explores our editor’s picks of the top loan finders that connect borrowers with UK payday loans direct lenders free of charge!

Best Payday Loans Direct Lenders UK 2024 - Editor’s Picks

● Overall Best Payday Loans Direct Lenders Only UK up to £5000

● Best No Refusal Payday Loans UK Direct Lenders Alternatives Starting From £100

● Best High Acceptance Payday Loans Direct Lenders UK with up to 24 Months to Pay

● Best Payday Loans UK Direct Lenders with Super Fast Applications & Quick Disbursements

● Best Mobile-Friendly Payday Loans Direct Lenders UK Applications That Take Mere Minutes.

Best Payday Loans Direct Lenders UK Bad Credit, No Credit Check – Full Reviews

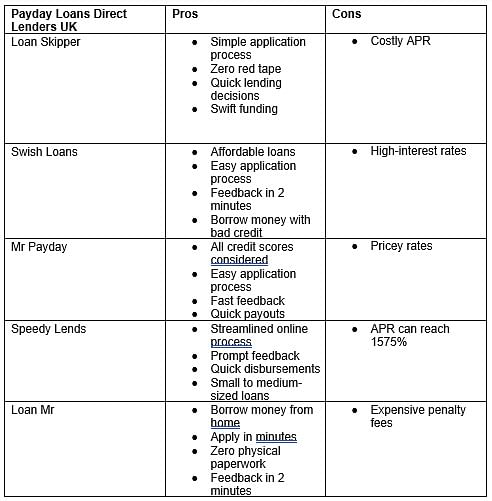

Loan Skipper – Overall Best Payday Loans Direct Lenders Only UK up to £5000

Quick Ratings:

● Decision Speed: 9/10

● Loan Amount Offering: 8/10

● Variety of Products: 9/10

● Acceptance Rate: 8/10

● Customer Support: 8/10

Loan Skipper partners with top lenders offering some of the best payday loans direct lenders only UK, and you can access them through a simple application. It’s easy to use and fast, with zero red tape and quick lending decisions where you can borrow up to £5,000 and get swift funding.

Highlights of Payday Loans Direct Lenders Only UK

● Simple application process

● Zero red tape

● Quick lending decisions

● Swift funding

● High amounts up to £5,000.

Eligibility Criteria to Apply for Payday Loans Direct Lenders Only Up to £5000

● 18+ years

● Legal UK citizen

● Active UK bank account

● Proof of income.

Fees and ARPS on Payday Loans Direct Lenders Only Up to £5000

● 45.3% to 1575% APR

● Early settlement charge.

Loan Skipper is a Credit Broker, not a Direct Lender.

Representative example: £1200 for 18 months at £90.46 per month. Total amount repayable of £1628.28. Interest: £428.28. Interest rate: 49.9% pa (variable). 49.9% APR Representative (variable). Rates from 45.3% APR to max 1575% APR - your APR will be based on your personal circumstances. Loans subject to status and subject to credit checks. Minimum repayment period is 90 days (3 months) from the date the loan is issued. Maximum repayment period is 24 months.

Warning: Late repayment can cause you serious money problems. For help go to moneyhelper.org.uk. All loans are subject to lender requirements and approval.

Swish Loans – Best No Refusal Payday Loans UK Direct Lenders Alternatives Starting From £100

Quick Ratings:

● Decision Speed: 9/10

● Loan Amount Offering: 9/10

● Variety of Products: 8/10

● Acceptance Rate: 8/10

● Customer Support: 7/10

Swish Loans is your best bet if you need a small loan without worrying about your credit score. It connects you to lenders offering some of the best no refusal payday loans UK direct lenders starting from £100 through an easy application process with 2-minute feedback. You can borrow the amount you can afford, even with a bad credit score, and repay when you get paid.

Highlights of No Refusal Payday Loans UK Direct Lenders Alternatives

● Affordable loans

● Easy application process

● Feedback in 2 minutes

● Borrow money with bad credit

● Quick disbursements

Eligibility Criteria to Apply for No Refusal Payday Loans UK Direct Lenders Alternatives Starting from £100

● At least 18 years of age

● Earn £1000 monthly

● UK citizen or resident

● Pass the affordability assessment

Fees and APRs on No Refusal Payday Loans UK Direct Lenders Alternatives

● Late payment penalty

● 45.3% minimum APR

● 1575% maximum APR.

Swish Loans is a Credit Broker, not a Direct Lender.

Representative example: £1200 for 18 months at £90.46 per month. Total amount repayable of £1628.28. Interest: £428.28. Interest rate: 49.9% pa (variable). 49.9% APR Representative (variable). Rates from 45.3% APR to max 1575% APR - your APR will be based on your personal circumstances. Loans subject to status and subject to credit checks. Minimum repayment period is 90 days (3 months) from the date the loan is issued. Maximum repayment period is 24 months.

Warning: Late repayment can cause you serious money problems. For help go to moneyhelper.org.uk. All loans are subject to lender requirements and approval.

Mr Payday – Best High Acceptance Payday Loans Direct Lenders UK with up to 24 Months to Pay

Quick Ratings:

Decision Speed: 8/10

Loan Amount Offering: 9/10

Variety of Products: 8/10

Acceptance Rate: 8/10

Customer Support: 7/10

It’s easy to get funded with Mr. Payday thanks to access to high acceptance payday loans direct lenders UK. It welcomes all eligible UK residents regardless of credit score and features an easy application process with fast feedback. You’ll get quick payouts and flexible repayment terms of up to 24 months.

Highlights of High Acceptance Payday Loans Direct Lenders UK with Up to 24 Months to Pay

● All credit scores considered

● Easy application process

● Fast feedback

● Quick payouts

● Flexible repayments

Eligibility Criteria to Apply for High Acceptance Payday Loans Direct Lenders UK with Up to 24 Months to Pay

● Minimum age of 18 years

● Proof of ID and address

● Legal UK citizen

● Active bank account

Fees and Interest on High Acceptance Payday Loans Direct Lenders UK with 2 Years to Pay

● Missed payment fee

● 45.3% to 1575% APR

● Early repayment charge.

Mr Payday is a Credit Broker, not a Direct Lender.

Representative example: £1200 for 18 months at £90.46 per month. Total amount repayable of £1628.28. Interest: £428.28. Interest rate: 49.9% pa (variable). 49.9% APR Representative (variable). Rates from 45.3% APR to max 1575% APR - your APR will be based on your personal circumstances. Loans subject to status and subject to credit checks. Minimum repayment period is 90 days (3 months) from the date the loan is issued. Maximum repayment period is 24 months.

Warning: Late repayment can cause you serious money problems. For help go to moneyhelper.org.uk. All loans are subject to lender requirements and approval.

Speedy Lends – Best Payday Loans UK Direct Lenders with Super Fast Applications & Quick Disbursements

Quick Ratings:

● Decision Speed: 8/10

● Loan Amount Offering: 8/10

● Variety of Products: 8/10

● Acceptance Rate: 7/10

● Customer Support: 8/10

With Speedy Lends, you can say goodbye to waiting around when you need funds in a hurry. A streamlined online process enables super-fast applications with prompt feedback and quick disbursements. You get free access to payday loans UK direct lenders offering small to medium-sized loans from £100 to £5000 with up to two years to repay through tailored terms.

Highlights of Payday Loans UK Direct Lenders with Super Fast Applications and Quick Disbursements

● Streamlined online process

● Prompt feedback

● Quick disbursements

● Small to medium-sized loans

● Tailored terms

Eligibility Criteria to Apply for Payday Loans UK Direct Lenders

● Legal adult above 18

● Earn at least £1000 monthly

● Pass the affordability assessment

● Proof of ID

Fees and APRs on Payday Loans UK Direct Lenders

● 45.3% minimum APR

● Missed payment fee

● Maximum APR of 1575%

Speedy Lends is a Credit Broker, not a Direct Lender.

Representative example: £1200 for 18 months at £90.46 per month. Total amount repayable of £1628.28. Interest: £428.28. Interest rate: 49.9% pa (variable). 49.9% APR Representative (variable). Rates from 45.3% APR to max 1575% APR - your APR will be based on your personal circumstances. Loans subject to status and subject to credit checks. Minimum repayment period is 90 days (3 months) from the date the loan is issued. Maximum repayment period is 24 months.

Warning: Late repayment can cause you serious money problems. For help go to moneyhelper.org.uk. All loans are subject to lender requirements and approval.

Loan Mr – Best Mobile-Friendly Payday Loans Direct Lenders UK Applications That Take Mere Minutes

Quick Ratings:

● Decision Speed: 9/10

● Loan Amount Offering: 8/10

● Variety of Products: 8/10

● Acceptance Rate: 7/10

● Customer Support: 8/10

Imagine applying for payday loans direct lenders UK from the comfort of your home through your mobile phone. That’s what you get with Loan Mr. You only need a few minutes to apply online with zero physical paperwork and get feedback in 2 minutes. Lenders disburse funds swiftly, and you get long repayment terms of up to 24 months with reasonable APR rates starting at 45.3%.

Highlights of Mobile-Friendly Payday Loans Direct Lenders UK Applications That Take Mere Minutes

● Borrow money from home

● Apply in minutes

● Zero physical paperwork

● Feedback in 2 minutes

● Swift disbursements

Eligibility Criteria to Apply for Mobile-Friendly Payday Loans Direct Lenders UK

● 18+ years

● Proof of regular income

● Legal UK citizen

● A valid form of ID

Fees and Interest on Mobile-Friendly Payday Loans Direct Lenders UK

● 45.3% to 1575% APR

● Late payment fee.

● Missed payment fee.

Loan Mr is a Credit Broker, not a Direct Lender.

Representative example: £1200 for 18 months at £90.46 per month. Total amount repayable of £1628.28. Interest: £428.28. Interest rate: 49.9% pa (variable). 49.9% APR Representative (variable). Rates from 45.3% APR to max 1575% APR - your APR will be based on your personal circumstances. Loans subject to status and subject to credit checks. Minimum repayment period is 90 days (3 months) from the date the loan is issued. Maximum repayment period is 24 months.

Warning: Late repayment can cause you serious money problems. For help go to moneyhelper.org.uk. All loans are subject to lender requirements and approval.

How Did We Choose Best Payday Loans UK Direct Lenders?

We looked for loan providers offering:

● Easy eligibility criteria

● Online loan processes

● Inclusive lending policies

● Flexible loan amounts and terms

● Quick payouts

Types of Payday Loans Direct Lenders UK and Higher Amounts

Unsecured £50 Payday Loans Direct Lenders UK

Unsecured £50 payday loans direct lenders UK don’t require you to provide your valuable assets as collateral.

Last Minute & Emergency Direct Lenders Payday Loans UK

Last minute and emergency direct lenders payday loans UK feature fast processing, approvals, and payouts to get you the funds you need when you need them.

Direct Lenders Payday Loans UK for Students

Direct lenders payday loans UK for students are suitable for young adults without a credit score or formal employment.

Direct Lenders Payday Loans UK for Self-Employed Entrepreneurs

Direct lenders payday loans UK for self employed entrepreneurs are suitable for borrowers with no formal jobs but with alternate sources of income.

Features & Factors of Payday Loans Direct Lenders New UK

Disbursement of Payday Loans Direct Lenders New UK Applications

Payday loans direct lenders new UK are disbursed as soon as possible after getting approved and finalizing the loan process.

Possible Additional Costs/Charges on Payday Loans Direct Lenders UK New Contracts

You may face penalty fees for missed or late repayments.

Poor Credit Payday Loans Direct Lenders UK Amounts & Terms

You can borrow from £100 to £5000 and repay in 3 to 24 months.

Credibility of the Providers Offering Poor Credit Payday Loans Direct Lenders UK

Providers offering poor credit payday loans direct lenders UK are reputable, licensed and transparent. They’re honest about their terms and fees, and you can easily find their reviews online.

List of Top 5 Best Payday Loans New Direct Lenders UK

How to Apply for Payday Loans New Direct Lenders UK

Follow these four steps on the Loan Skipper website to apply for payday loans direct lenders UK:

Step 1: Choose the New Payday Loans Direct Lenders UK Required Amount and Term

Indicate how much you need, from £100 to £5000, and a suitable repayment term from 3 to 24 months.

Step 2: Complete the New Payday Loans Direct Lenders UK Application Form

Take a few minutes to fill in your personal, employment, income, and monthly expenditure details to help lenders verify that you qualify for new payday loans direct lenders UK.

Step 3: Receive Speedy Response on Direct Lenders Payday Loans Online UK

Within 2 minutes of submitting your completed application, you’ll know whether or not you qualify. A lender who can help you will send you a loan offer, and once you accept, you’ll receive a loan contract to review and accept. Read it carefully, then sign and return it to the lender.

Step 4: Receive Fast Disbursement of Approved Direct Lenders Payday Loans Online UK

Lenders are quick with payouts and will send the approved amount directly into your account as soon as possible.

FAQ’s

Can I Borrow Online Payday Loans Direct Lenders UK with Bad Credit?

Yes! You can borrow online payday loans direct lenders UK with credit from specialized lenders who focus on your affordability instead of your credit issues.

How Will I Repay Online Payday Loans Direct Lenders UK?

The lender will automatically debit your account once you finalize the deal and sign the loan contract. It makes repayments super convenient by deducting the due amount automatically once you receive your income.

What Interest Rate Will I Get with Payday Loans Online Direct Lenders UK?

You can expect a reasonable APR rate from 45.3% to 1575%. Factors like your risk profile and credit can influence the rate you get from the lender.

Do Payday Loans Direct Lenders UK Require Credit Checks?

Yes. All reputable lenders must conduct credit checks to adhere to lending regulations. If you’re worried about your credit score, don’t be. You can still access payday loans direct lenders UK for bad credit borrowers from specialized lenders.

What Income Do I Need to Qualify for UK Payday Loans Direct Lenders Only?

Most lenders require that you earn at least £1000 monthly to qualify.

Why Was My UK Payday Loans Direct Lenders Only Application Rejected?

A common reason for rejected applications is requesting an amount that exceeds your affordability. Ensure you only request an amount you can comfortably afford based on your income and monthly expenses.

Can I Borrow UK Payday Loans Direct Lenders Without a Job?

Yes! But you must have an alternate source of income and prove you can afford repayments. Alternate income sources include rental income, dividends, trust proceeds, self-employment earnings and child support.

Conclusion

Payday loans direct lenders UK provide you with a lump sum amount upfront which you can repay quickly, within a few months or years. You can access some of the best payday loans direct lenders UK through a fast and convenient application process at Loan Skipper. It features easy eligibility, quick approvals, and inclusive terms that welcome borrowers with bad credit or non-traditional jobs. Apply today through simple steps and borrow from £100 to £5000 with 3 to 24 months of repayments!

Disclaimer: The websites advertised in this paid promotion are credit brokers, not direct lenders. All loans are subject to lender requirements and approval. Season Marketing does not charge customers a fee for using its broker services, but it might receive a commission from lenders or other brokers following an introduction through their websites.

Deccan Herald is on WhatsApp Channels | Join now for Breaking News & Editor's Picks